Compare fees, credentials, and histories across 400,000+ fiduciary advisors—powered by 25 years of SEC filings. No login required.

Unlike brokers or insurance agents who may recommend products that pay them higher commissions, Registered Investment Advisors are bound by law to put your interests first. This fiduciary duty means they must disclose conflicts of interest and recommend what's best for you—not what's most profitable for them.

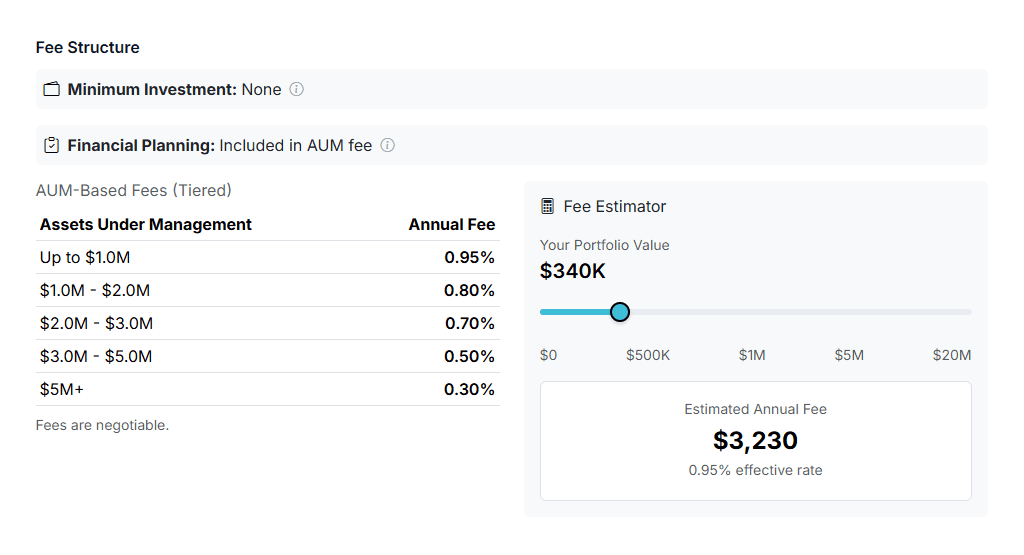

See actual fee schedules from SEC brochures. Calculate your estimated annual cost before reaching out.

Find advisors

See designations like CFP and CFA, years of experience, and any disciplinary disclosures—all from SEC records.

Browse advisorsFilter by average client portfolio, firm size, areas of practice, and compensation type to find advisors who serve clients like you.

Start searchingEnter your zipcode or take our guided quiz.

Review fees, credentials, and fit.

Schedule a video or phone consultation directly.

Honestly? Not everyone does. Here's how to know.

Consider low-cost index funds and robo-advisors instead—they charge 0.25% or less.

A good advisor can save you money through tax optimization alone.

All data from official Form ADV filings.

Fresh data from the latest filings.

Including disclosures and disciplinary history.

No cost to search or contact advisors.

Learn about fee structures, credentials, and what to look for.

Learning Center